Common Myths About Public Adjusters You Should Ignore

Public adjusters often find themselves at the center of numerous misconceptions and myths, many of which can deter property owners from seeking their invaluable services. Understanding these myths is crucial to making informed decisions after experiencing property damage or loss.

One prevalent myth is that public adjusters are unnecessary because insurance companies will always provide a fair settlement. While it’s true that insurance companies have in-house adjusters, these professionals work on behalf of the insurer, not the policyholder. Their primary goal is to protect the company’s financial interests, which may not align with maximizing your claim payout. Public adjusters, on the other hand, advocate for you, ensuring that you receive a fair and comprehensive settlement based on your policy’s terms.

Another common misconception is that hiring a public adjuster will delay the claims process. In reality, public adjusters are skilled negotiators who expedite claims by thoroughly documenting losses and navigating complex policy language efficiently. They understand how to present claims in a manner that aligns with insurance protocols, often resulting in faster resolutions than if homeowners attempted to handle everything independently.

Some people believe that all public adjusters charge exorbitant fees or take an unreasonable percentage of the claim settlement. However, most public adjusters see more operate on a contingency fee basis—a percentage agreed upon before any work begins—and only receive payment once you do. This arrangement aligns their incentives with yours: securing the highest possible settlement promptly benefits both parties financially.

There is also a myth suggesting that using a public adjuster could lead to higher premiums or even cancellation of coverage by insurers retaliating against those who hire them. Insurance regulations prohibit such punitive actions when policyholders exercise their right to representation during claims processes. Public adjusters ensure compliance with all relevant laws and guidelines while advocating for rightful settlements without risking future insurability.

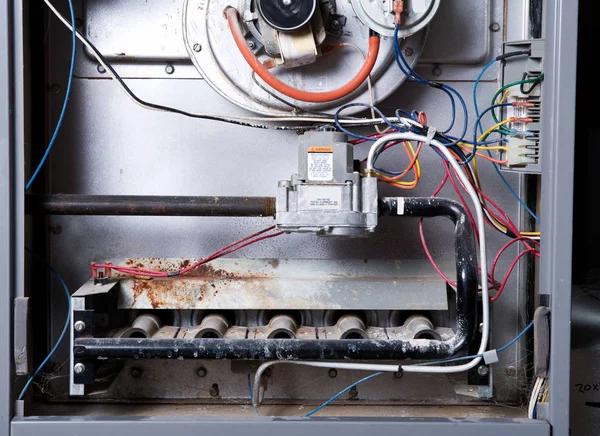

Additionally, some assume they only need public adjusters for large-scale disasters like hurricanes or floods; however, these professionals can be invaluable for smaller claims as well—such as water leaks or fire damage—that might otherwise be underestimated by company-employed assessors.

Lastly, there’s an unfounded belief that anyone can become a successful DIY claimant without professional help if they simply research enough online resources about insurance policies and procedures. While self-education is beneficial up to an extent; it cannot replace years of experience possessed by licensed experts familiarized with industry intricacies beyond what’s publicly accessible knowledge-wise alone.

In conclusion; understanding what constitutes misinformation versus fact concerning hiring professional advocates during challenging times involving personal property recovery efforts ensures better decision-making outcomes overall regarding protecting one’s financial interests effectively long-term throughout inevitable unforeseen events impacting homeownership realities today tomorrow alike!